Best 7 AI Tools Accounting Software (2025)

In 2025, AI accounting software 2025 has become essential for modern businesses looking to streamline financial operations with automation and intelligence. The accounting industry is experiencing a revolutionary transformation as artificial intelligence fundamentally reshapes how businesses manage their financial operations. In 2025, AI-powered accounting software has evolved from simple automation tools to sophisticated platforms that leverage machine learning, predictive analytics, and natural language processing to streamline complex financial processes. This technological advancement is enabling businesses to reduce manual data entry by up to 80%, minimize human errors, and gain deeper insights into their financial health through intelligent reporting and forecasting capabilities.

Modern AI accounting software solutions are designed to handle everything from automated bookkeeping and expense categorization to compliance monitoring and tax preparation. These intelligent systems can analyze vast amounts of financial data in real-time, identify patterns and anomalies, and provide actionable insights that help businesses make informed decisions. The integration of AI in accounting has become particularly crucial for small businesses and enterprises alike, as it allows them to compete effectively by automating routine tasks while maintaining accuracy and compliance with ever-changing regulations.

The benefits of implementing AI-powered accounting tools extend far beyond simple cost savings. These systems enhance efficiency by automating repetitive tasks, improve accuracy through intelligent error detection, and provide scalability that grows with your business. Furthermore, AI accounting software offers enhanced security features, real-time collaboration capabilities, and seamless integration with other business systems, making it an essential investment for companies looking to modernize their financial operations in 2025.

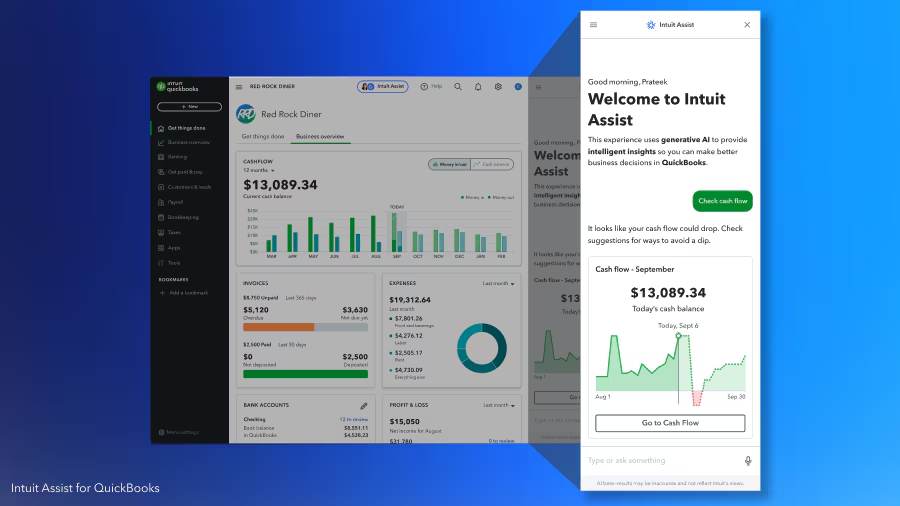

1. QuickBooks: Leading AI Accounting Software 2025 for SMEs

QuickBooks Online has emerged as a leader in AI-powered accounting software, incorporating advanced AI features through Intuit Assist, an intelligent assistant that helps users manage invoices, categorize transactions, and gain valuable insights into their financial data. This cloud-based accounting solution combines traditional bookkeeping functionality with cutting-edge machine learning capabilities, making it an ideal choice for small to medium-sized enterprises seeking reliable, scalable automation.

The AI capabilities in QuickBooks Online are particularly impressive in their ability to learn from user behavior and automatically categorize transactions with increasing accuracy over time. Intuit Assist can help with invoice generation, expense tracking, and financial reporting, while providing intelligent suggestions for optimizing cash flow and identifying potential tax deductions. The software’s predictive analytics feature helps businesses forecast future financial trends and make data-driven decisions.

QuickBooks Online excels in its integration ecosystem, seamlessly connecting with over 750 third-party applications including payment processors, CRM systems, and e-commerce platforms. This extensive connectivity makes it particularly valuable for businesses that rely on multiple software solutions. The platform’s automated bank reconciliation feature uses AI to match transactions and identify discrepancies, significantly reducing the time spent on monthly reconciliations.

QuickBooks offers four pricing tiers: Simple Start at $15 per month, Essentials at $30 per month, Plus at $45 per month, and Advanced at $100 per month. Each step up allows access to more users and features. The software is best suited for small businesses, freelancers, and growing companies that need comprehensive accounting functionality with intelligent automation capabilities.

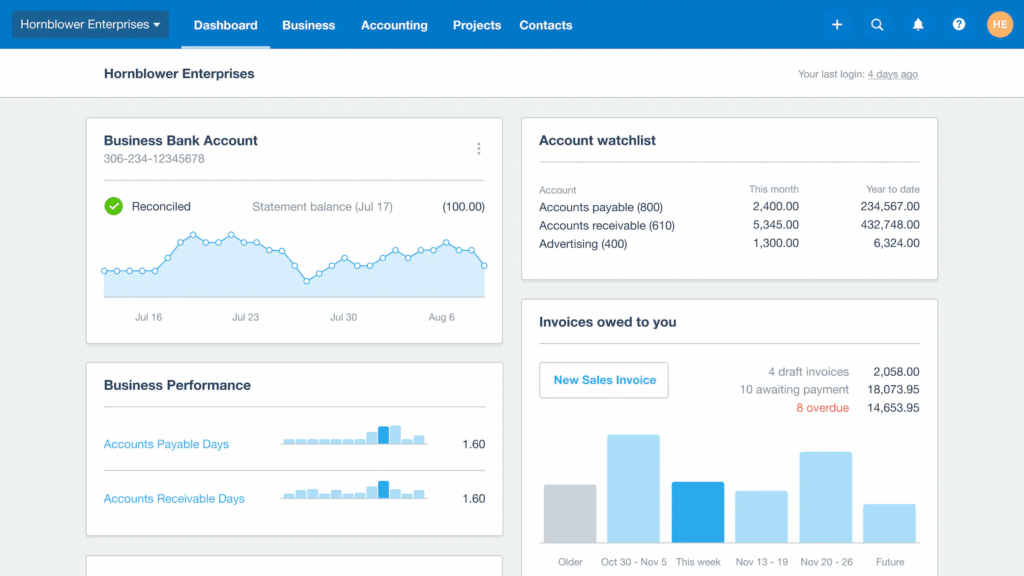

2. Xero – Cloud Accounting with AI Features

Xero has established itself as a premier cloud accounting platform that leverages artificial intelligence to streamline financial management for businesses of all sizes. The software’s AI-powered features include intelligent bank reconciliation, automated invoice processing, and predictive cash flow forecasting that helps businesses maintain optimal financial health. Xero’s machine learning algorithms continuously analyze transaction patterns to improve accuracy and reduce manual intervention.

The platform’s AI capabilities shine particularly in its automated expense management system, which can categorize expenses, extract data from receipts using optical character recognition (OCR), and flag unusual spending patterns. Xero’s intelligent reporting system provides real-time financial insights with customizable dashboards that highlight key performance indicators and financial trends. The software’s AI-driven inventory management feature helps businesses optimize stock levels and reduce carrying costs through predictive analytics.

Xero’s strength lies in its extensive app marketplace, offering over 1,000 integrations with third-party applications including payroll systems, point-of-sale software, and business intelligence tools. This flexibility makes it particularly attractive to businesses with complex operational requirements. The platform’s multi-currency support and automated tax compliance features make it ideal for international businesses and those operating across multiple jurisdictions.

Xero’s paid plan starts at $2.90/month, making it one of the most affordable AI accounting solutions available. The platform offers three main pricing tiers designed to modate different business sizes and complexity levels. Xero is particularly well-suited for small businesses, startups, and growing companies that require robust cloud accounting capabilities with intelligent automation features.

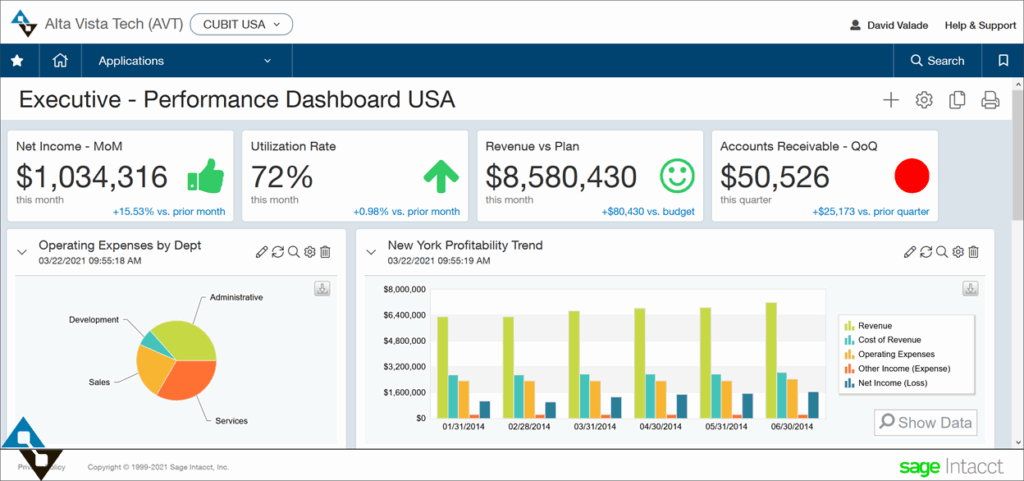

3. a- Advanced AI for Enterprise Accounting

Sage Intacct represents the pinnacle of AI-powered accounting software designed specifically for mid-market and enterprise-level organizations. Sage is a finance platform that includes a wealth of business intelligence features. The company’s two leading solutions, Sage Intacct and Sage X3, are analytics-enhanced versions that leverage machine learning to provide sophisticated financial management capabilities. The platform’s AI engine excels in complex financial operations, multi-entity management, and advanced reporting requirements.

The AI capabilities in Sage Intacct are particularly robust in areas such as automated financial close processes, intelligent variance analysis, and predictive financial planning. The software’s machine learning algorithms can identify patterns in financial data that might indicate fraud or errors, while its AI-powered reconciliation features can handle complex multi-entity transactions with minimal human intervention. The platform’s advanced analytics provide deep insights into financial performance, helping CFOs and finance teams make strategic decisions.

Sage Intacct’s strength lies in its ability to handle complex accounting requirements such as revenue recognition, project accounting, and multi-dimensional reporting. The software’s AI-enhanced budgeting and forecasting tools use historical data and market trends to create accurate financial projections. Its automated compliance features ensure adherence to various accounting standards including GAAP, IFRS, and industry-specific regulations.

The platform operates on a subscription-based pricing model that varies based on modules, users, and company size, typically ranging from $400 to $2,000+ per month. Sage Intacct is ideally suited for growing businesses, mid-market companies, and enterprises that require sophisticated financial management capabilities with advanced AI-powered analytics and reporting features.

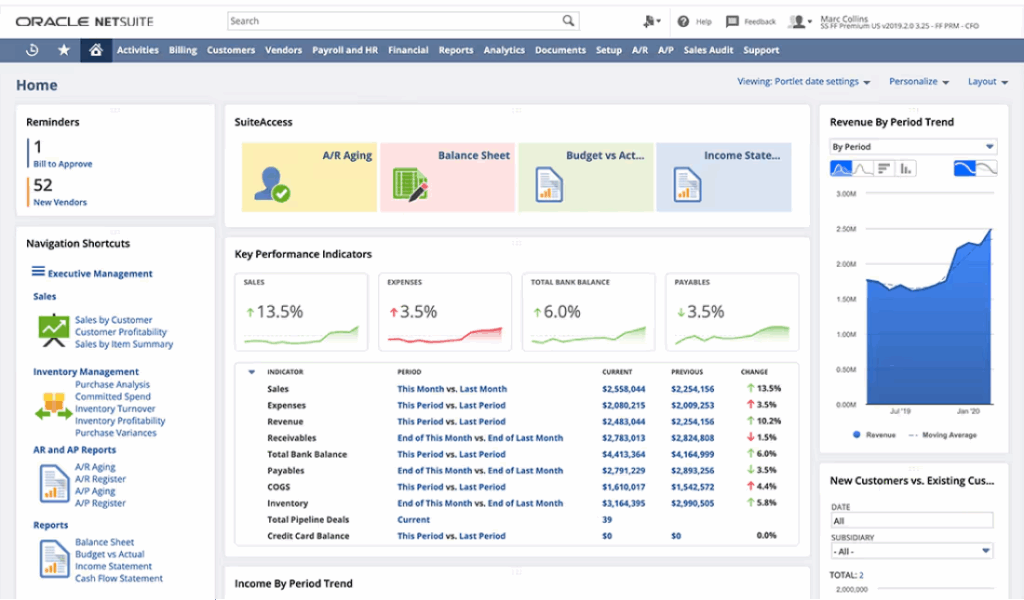

4. NetSuite ERP – AI-Powered Financial Management

NetSuite ERP stands out as a comprehensive cloud-based business management suite that incorporates advanced artificial intelligence throughout its financial management modules. AI features such as lease abstraction, flux analysis, and asset creating make it a leader in the AI accounting software space. The platform’s AI capabilities extend beyond traditional accounting to encompass enterprise resource planning, customer relationship management, and e-commerce functionality.

The AI-powered features in NetSuite include intelligent financial reporting, automated revenue recognition, and predictive analytics that help businesses optimize their financial performance. The software’s machine learning algorithms can analyze large datasets to identify trends, anomalies, and opportunities for cost savings. NetSuite’s AI-driven cash flow management provides real-time visibility into financial positions and helps businesses make informed decisions about investments and expenditures.

NetSuite excels in its ability to provide a unified view of business operations through its integrated approach to financial management. The platform’s AI-enhanced inventory management, order processing, and supply chain optimization features work seamlessly with its accounting modules to provide comprehensive business intelligence. The software’s customizable dashboards and automated reporting capabilities ensure that stakeholders have access to relevant financial information in real-time.

The platform’s pricing structure is typically customized based on specific business requirements, number of users, and modules selected, with costs generally ranging from $1,000 to $5,000+ per month. NetSuite ERP is best suited for medium to large enterprises that require comprehensive business management capabilities with advanced AI-powered financial analytics and reporting features.

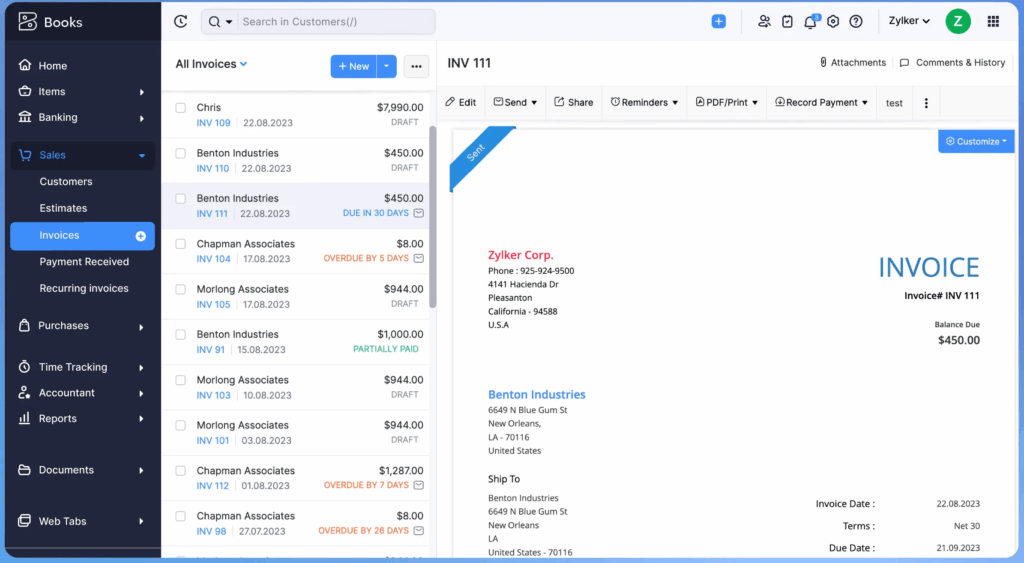

5. Zoho Books – AI Accounting for Small Businesses

Zoho Books is a cloud-based accounting software tailored for small businesses and freelancers. It offers a comprehensive suite of tools to manage finances, including invoicing, expense tracking, and inventory management. The platform has integrated artificial intelligence features that automate routine accounting tasks while maintaining affordability and simplicity for smaller organizations.

Zoho Books’ AI capabilities focus on streamlining everyday accounting processes through intelligent automation. The software’s machine learning algorithms can automatically categorize expenses, reconcile bank transactions, and generate financial reports with minimal user input. Its AI-powered invoice processing can extract data from receipts and bills, while the intelligent expense tracking system learns from user behavior to improve accuracy over time.

The platform’s strength lies in its integration with the broader Zoho ecosystem, allowing seamless data flow between CRM, project management, and other business applications. Zoho Books’ AI-enhanced inventory management helps small businesses optimize stock levels and reduce carrying costs through predictive analytics. The software’s automated tax compliance features ensure accurate calculations and timely filings across multiple jurisdictions.

Zoho Books offers a free plan for basic accounting needs and paid plans starting at $10 per month for more advanced features. The platform provides excellent value for money while delivering sophisticated AI capabilities typically found in more expensive enterprise solutions. It’s particularly well-suited for small businesses, startups, freelancers, and growing companies that need comprehensive accounting functionality without the complexity of enterprise-level systems.

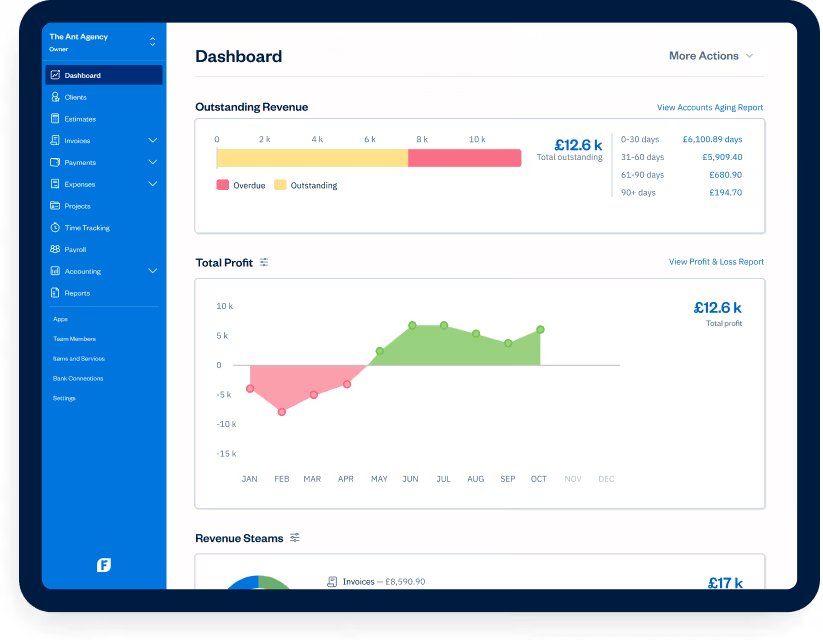

6. FreshBooks – AI-Powered Time Tracking and Invoicing

FreshBooks has evolved into a sophisticated AI-powered accounting platform that specializes in time tracking, invoicing, and project management for service-based businesses. The software’s artificial intelligence capabilities focus on automating client management, expense tracking, and financial reporting while maintaining a user-friendly interface that requires minimal training.

The AI features in FreshBooks include intelligent time tracking that can automatically categorize activities, smart invoicing that learns from past billing patterns, and predictive analytics that help businesses optimize their pricing strategies. The platform’s machine learning algorithms analyze client behavior to provide insights into payment patterns and identify potential collection issues before they become problematic.

FreshBooks excels in its mobile application, which uses AI to capture expense receipts, track time automatically, and provide real-time financial insights on the go. The software’s AI-powered reporting system generates customizable financial reports that highlight key performance indicators and business trends. Its automated late payment reminders and intelligent payment processing help businesses maintain healthy cash flow.

The platform offers plans starting at $17 per month for freelancers and small businesses, with higher-tier plans providing additional features and user capacity. FreshBooks is ideally suited for service-based businesses, consultants, freelancers, and small agencies that need comprehensive time tracking and invoicing capabilities with intelligent automation features.

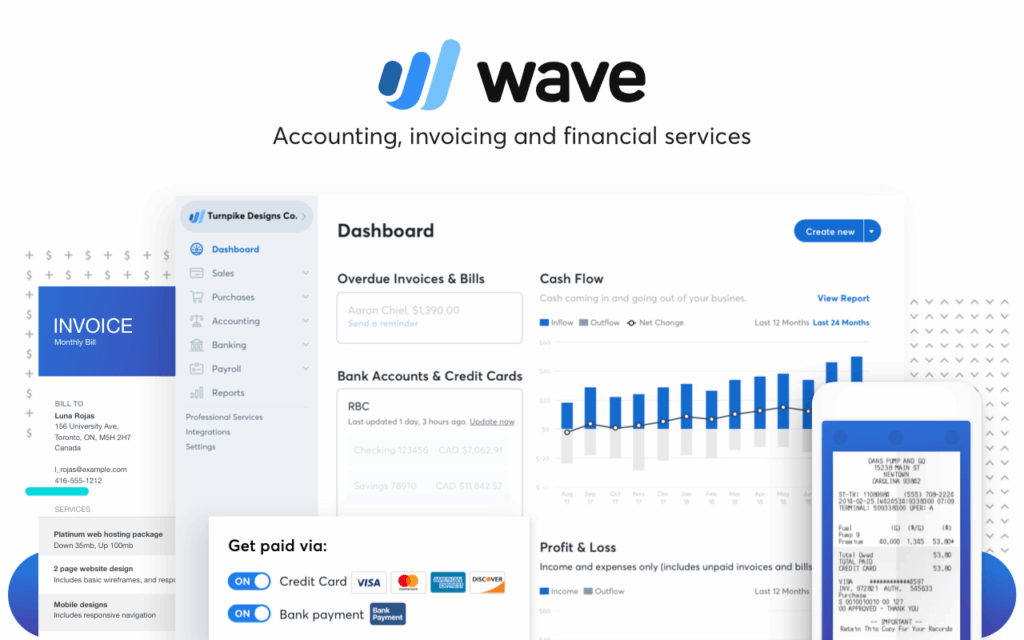

7. Wave Accounting – Free AI-Powered Accounting

Wave Accounting distinguishes itself as a free AI-powered accounting platform that provides comprehensive financial management capabilities without the typical cost barriers. The software leverages artificial intelligence to automate bookkeeping tasks, streamline expense management, and provide intelligent financial insights that help small businesses maintain accurate financial records.

The AI capabilities in Wave include automated transaction categorization, intelligent receipt scanning, and predictive cash flow analysis that helps businesses anticipate financial needs. The platform’s machine learning algorithms continuously improve accuracy by learning from user corrections and industry-specific patterns. Wave’s AI-powered reconciliation features can match transactions across multiple accounts and identify discrepancies automatically.

Wave’s strength lies in its ability to provide enterprise-level accounting functionality at no cost, making it accessible to startups and very small businesses that might otherwise struggle to afford comprehensive accounting software. The platform’s AI-enhanced invoicing system can generate professional invoices, track payments, and send automated reminders to clients. Its integrated payment processing and payroll features provide a complete financial management solution.

While the core accounting features are free, Wave generates revenue through optional paid services such as payment processing and payroll, which are competitively priced. The platform is particularly well-suited for freelancers, sole proprietors, and small businesses that need reliable accounting software with AI capabilities but have limited budgets for financial management tools.

Comparison Table: AI Accounting Software Features

| Tool Name | Key AI Features | Best Use Case | Starting Price | Platform |

| QuickBooks Online | Intuit Assist, automated categorization, predictive analytics | Small to medium businesses | $15/month | Cloud-based |

| Xero | Intelligent reconciliation, automated expense management, predictive forecasting | Small businesses, startups | $2.90/month | Cloud-based |

| Sage Intacct | Advanced analytics, automated close processes, fraud detection | Mid-market to enterprise | $400+/month | Cloud-based |

| NetSuite ERP | Comprehensive AI integration, predictive analytics, automated compliance | Medium to large enterprises | $1,000+/month | Cloud-based |

| Zoho Books | Automated categorization, intelligent invoicing, expense tracking | Small businesses, freelancers | $10/month | Cloud-based |

| FreshBooks | Smart time tracking, automated invoicing, predictive client insights | Service-based businesses | $17/month | Cloud-based |

| Wave Accounting | Free AI categorization, automated reconciliation, receipt scanning | Freelancers, startups | Free | Cloud-based |

Frequently Asked Questions

1. What is the best AI accounting software in 2025?

The best AI accounting software depends on your specific business needs and size. For small businesses, QuickBooks Online with Intuit Assist offers the best balance of features and affordability. Xero provides excellent value with its comprehensive AI capabilities starting at just $2.90/month. For enterprises, Sage Intacct and NetSuite ERP offer advanced AI features for complex financial management requirements.

2. Can AI tools automate bookkeeping and taxes?

Yes, modern AI accounting software can significantly automate bookkeeping and tax-related tasks. These tools can automatically categorize transactions, reconcile bank statements, generate financial reports, and calculate tax obligations. However, complex tax situations may still require professional oversight to ensure compliance with current regulations and optimize tax strategies.

3. Are these AI accounting tools suitable for small businesses?

Absolutely! Many AI accounting tools are specifically designed for small businesses, offering affordable pricing and user-friendly interfaces. Wave Accounting provides free AI-powered accounting features, while Xero and Zoho Books offer comprehensive solutions at very competitive prices. These tools can help small businesses automate routine tasks and gain insights typically available only to larger organizations.

4. What are the benefits of using AI in accounting?

AI in accounting offers numerous benefits including reduced manual data entry, improved accuracy through intelligent error detection, faster financial reporting, predictive analytics for better decision-making, automated compliance monitoring, and enhanced fraud detection. These capabilities help businesses save time, reduce costs, and make more informed financial decisions.

5. How secure is AI-powered accounting software?

Leading AI accounting software providers implement enterprise-grade security measures including data encryption, multi-factor authentication, regular security audits, and compliance with industry standards such as SOC 2 and ISO 27001. Cloud-based solutions often provide better security than on-premise systems due to their dedicated security teams and regular updates.

6. Is there free AI accounting software available?

Yes, Wave Accounting offers comprehensive AI-powered accounting features completely free, making it an excellent option for freelancers and small businesses. While the core accounting functionality is free, Wave generates revenue through optional paid services like payment processing and payroll. Other providers like Xero and QuickBooks also offer free trials to test their AI capabilities.

7. How do I choose the right AI accounting software for my business?

Consider factors such as your business size, industry requirements, budget, integration needs, and desired AI capabilities. Start with a free trial or demo to evaluate user interface and features. Assess your current accounting processes to identify areas where AI automation would provide the most value. Consider scalability to ensure the software can grow with your business.

8. What AI features should I look for in accounting software?

Key AI features to consider include automated transaction categorization, intelligent bank reconciliation, predictive cash flow analysis, automated expense management, fraud detection capabilities, smart invoicing, and AI-powered reporting. Look for software that offers machine learning capabilities that improve accuracy over time and provide actionable insights for business decision-making.

Conclusion

The landscape of AI accounting software in 2025 represents a fundamental shift in how businesses manage their financial operations. The integration of artificial intelligence into accounting platforms has moved beyond simple automation to provide sophisticated analytics, predictive insights, and intelligent decision-making capabilities that were previously available only to large enterprises with dedicated IT resources. Adopting AI accounting software 2025 is no longer optional—it’s a strategic move to stay competitive, efficient, and compliant in the digital economy.

For small businesses and freelancers, tools like Wave Accounting, Xero, and Zoho Books offer powerful AI capabilities at accessible price points, enabling them to compete effectively with larger organizations. These platforms provide automated bookkeeping, intelligent expense management, and predictive analytics that help small businesses maintain accurate financial records while focusing on growth and client service.

Medium-sized businesses and enterprises can benefit from more advanced solutions like Sage Intacct and NetSuite ERP, which offer comprehensive AI-powered features including automated compliance monitoring, advanced analytics, and multi-entity management capabilities. These platforms provide the scalability and sophistication needed to handle complex financial operations while maintaining accuracy and regulatory compliance.

The choice of AI accounting software ultimately depends on your specific business requirements, budget constraints, and growth objectives. Consider factors such as ease of use, integration capabilities, scalability, and the specific AI features that will provide the most value for your organization. Whether you’re a freelancer managing basic invoicing or a large enterprise handling complex financial operations, there’s an AI-powered accounting solution designed to meet your needs.

As we move forward in 2025, the adoption of AI in accounting will continue to accelerate, driven by the need for greater efficiency, accuracy, and insights in financial management. Businesses that embrace these technologies now will be better positioned to adapt to future changes and maintain competitive advantages in an increasingly digital economy. The investment in AI accounting software is not just about improving current operations—it’s about preparing for the future of financial management.